![[Bookcover]](BC-app_re_s.jpg)

Published by the Appraisal Institute, 2001

Copyright © 2001 Property Valuation Advisors, Newburyport, MA

![[Bookcover]](BC-app_re_s.jpg)

If you are looking for the most thorough and useful real estate appraisal text available today, get the new edition of The Appraisal of Real Estate, 12th Edition.

Like previous editions, it contains everything you need to know about real estate appraising. But now it is expanded in the areas in which appraising has expanded in the past few years. Some of the existing material is now presented in an improved and more graphical manner.

The chapter on "Real Estate Markets" has expanded from 24 to 40 pages. In this chapter we are shown that real estate markets are not efficient primarily because each parcel of real estate is unique. Despite this inefficiency, however, the securitization of real estate and easier access to transaction information are making markets more efficient today than in the past. As always, markets are subject to cycles. The book contains an eye-opening chart pointing out these cycles and the positive correlation between the growth in national Gross Domestic Product (GDP) and the growth in real estate returns.

The new edition also includes more explanation about Real Estate Market Analysis. It focuses on the relationship of market analysis to highest and best use analysis.

To conduct a market analysis, one must distinguish the most relevant market participants from the market at large. In this chapter, we are introduced to the term, disaggregation: the differentiation of a subject property from other properties based on differing property characteristics.

We are informed that market analysis should show how the interaction of supply and demand affects a property's value. This can be accomplished by investigating the reasoning behind the price paid and it should explain the why of value.

The book examines the various levels of market analysis available to appraisers. These levels include the less formal and less rigorous inferred market analysis and the more formal and more in-depth, fundamental market analysis.

Next, in the expanded Highest and Best Use analysis chapter, one finds information helpful in considering the probability of a zoning change or an assemblage or determining highest and best use for properties created for a special-purpose. With regard to special use properties, the text advises: "Sometimes a special-purpose property must be analyzed and appraised on the basis of two highest and best uses -- i.e., continuation of the existing special purpose use and conversion to an alternative use."

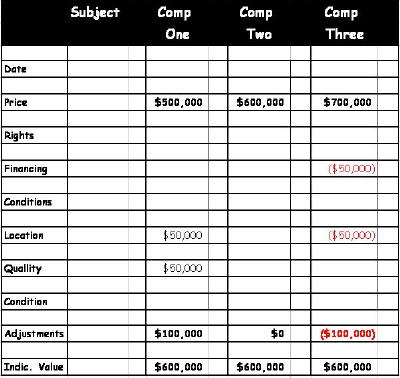

Expanded information is also included in the chapter on "Adjustment and Analytical Techniques in the Sales Comparison Approach". One of the sales comparison method expounded upon is qualitative analysis. This technique divides the adjusted comparables into two groups: those that are qualitatively superior and those that are qualitatively inferior. The adjusted prices of these two groups then bracket the value of the subject. A variant of this technique is ranking analysis in which comparable sales are ranked in descending or ascending order of desirability. Each comparable is analyzed to determine its relative position to the subject.

One of the more topical chapters deals with appraisal specialties and emerging valuation issues. The controversial topic of Business Enterprise Value (BEV), also called Capitalized Economic Profit (CEP) is discussed. This becomes important when the real estate value must be separated from the value of the other assets. If other assets exist, the combined assets are known as Total Assets of a Business (TAB).

... lack

of universal acceptance of the theory, especially in courts.

In theory, TAB may include real property, tangible personal property, and intangible personal property such as contracts, a prestigious product name or company name, patents, or copyrights, etc. The existence of BEV or CEP is considered more credible when the sale price is greater than reproduction or replacement cost less depreciation (plus land value), or when the net income for the business is derived primarily from the sale of a product or a service, etc.

Opponents of the theory of BEV or CEP in real estate point to the lack of universal acceptance of the theory, especially in courts. They claim that purported intangible value merely could be a function of a premium location. Opponents of BEV or CEP also argue that it does not exist if it cannot be sold or transferred to another location or it is not recognized as a separate item in the negotiation.

One of a few of the emerging specialties examined includes litigation work. The book includes advise for appraisers when appraising for litigation purposes as well as the ten courtroom commandments for appraisers.

Overall, the new edition sports an updated design with new graphics and relevant end-of-chapter bibliographies. Although geared towards appraisers, the book still can be useful to others. Moreover, the new edition, as it always has, contains not only valuation theory demonstrating each of the traditional approaches to value, but also keeps abreast of the changes that have taken place in appraisal practice. Considering the evolving discipline of real property valuation, no other book available is as a complete, reliable, and up-to-date text. As a storehouse of the current body of appraisal knowledge, The Appraisal of Real Estate 12th Edition remains the best real estate appraisal resource available.

The book above, Land Valuation: Adjustment Procedures and Assignments, is available on-line at Amazon Books.

Stephen Traub, ASA, the reviewer, is chief commercial appraiser for Property Valuation Advisors, 63 Hill St., Newburyport, MA 01950. He is a certified general appraiser in NH, ME, and MA.

To contact the author of this review, e-mail to:

![[Mailbox]](mailbox.gif) straub@shore.net

or contact him at the address above, or call 978-462-4347.

straub@shore.net

or contact him at the address above, or call 978-462-4347.

| PVM Fall 2001 story menu | PVM archive menu | PVM's intro page | PVA's Free RE Publication menu | Property Valuation Advisors front page |

Copyright © 2001 Property Valuation Advisors, Newburyport, MA. All rights reserved.

Disclaimer

Copyright © 2001 Property Valuation Advisors, Newburyport, MA. All rights reserved.

Disclaimer